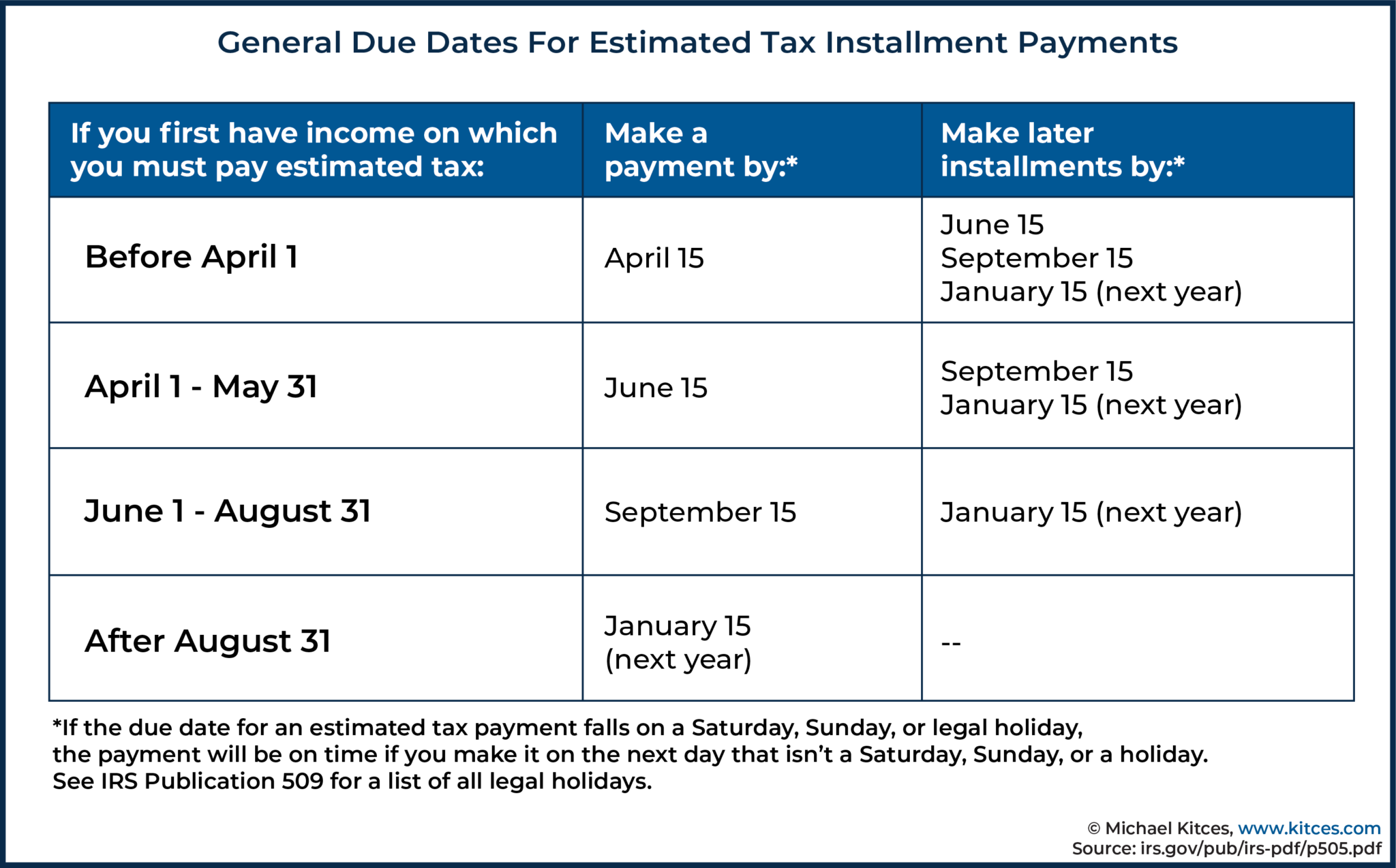

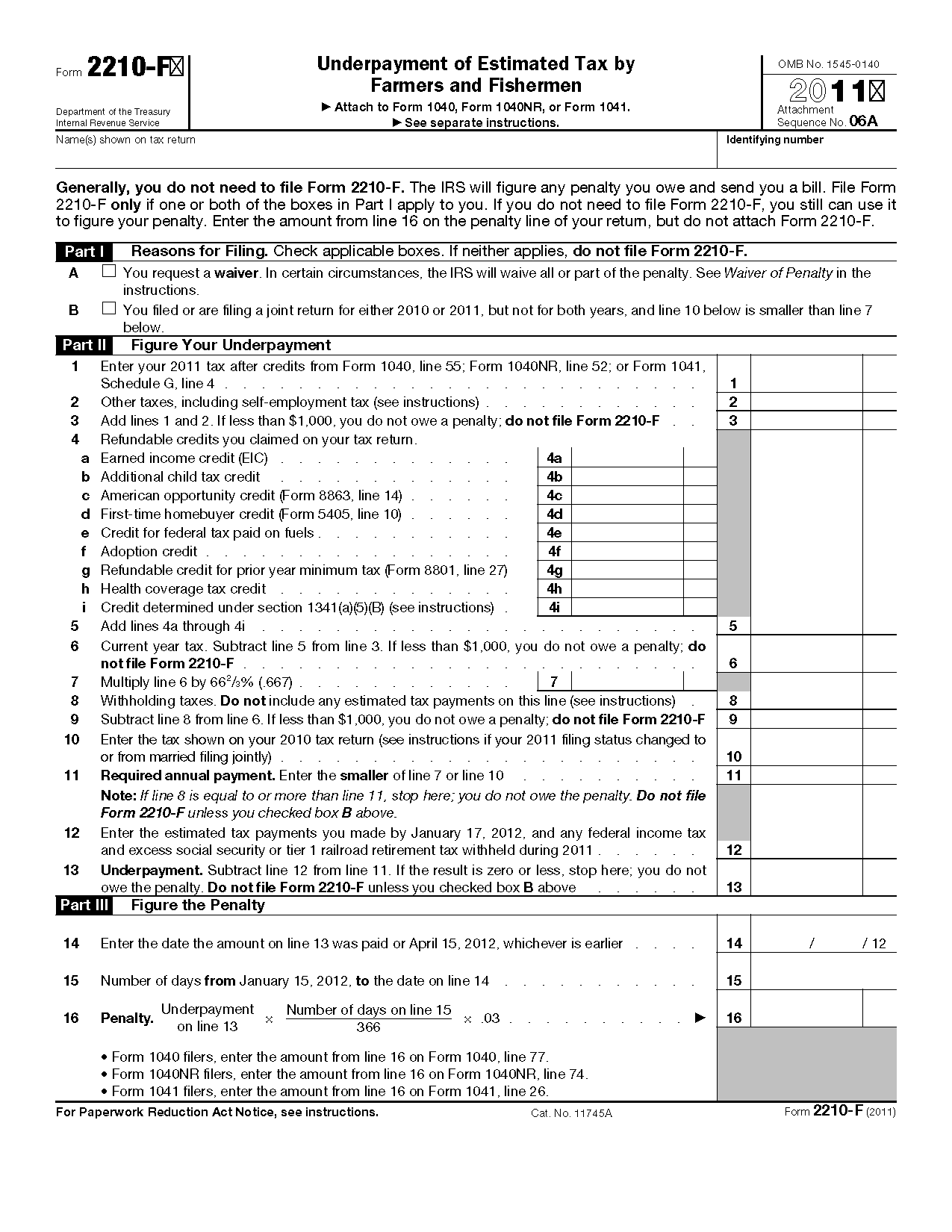

Estimated Tax Payments 2024 For Llc. Corporate installments of estimated tax payments are generally due by the 15th day of the 4th, 6th, 9th, and 12th months of the tax year. Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding.

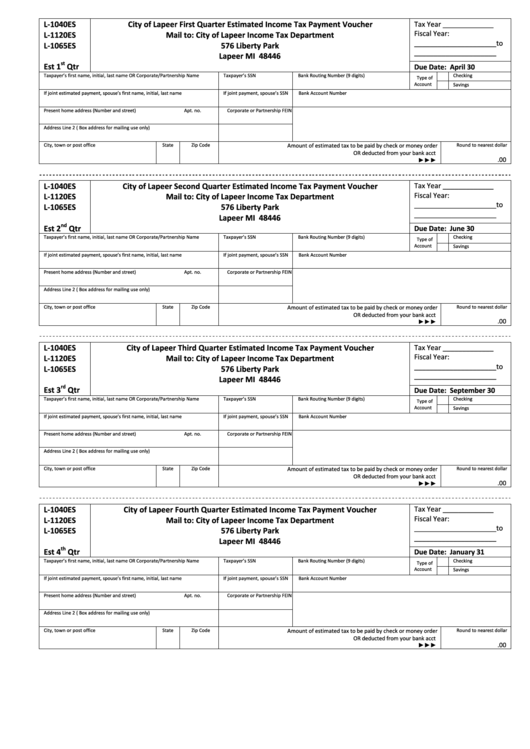

Llc Tax Return Due Date 2024 Dennie Phillis, There are four quarterly estimated tax payments that must be made in a fiscal year. If a federal tax deadline falls on a weekend or legal holiday, the due.

Estimated Tax Due Dates 2024 Form 2024Es 2024 Angele Valene, 2q — june 17, 2024; At creative advising, we prioritize this.

How Do I Calculate My Estimated Taxes For 2024 Hanny Kirstin, Estimated tax payment deadlines for businesses in 2024. For 2024, payment for the first quarter is due april 15, the second quarter on june 17, and.

2024 Estimated Tax Due Dates Alice Brandice, Important due dates for estimated tax payment. Estimated tax is the tax you expect to owe for the current tax year after subtracting:

2024 4th Quarter Estimated Tax Payment Gabey Shelia, At creative advising, we prioritize this. Estimated quarterly tax payments are due four times per year, on the 15th of april, june, september, and january (or the next business day if it’s a weekend or holiday).

Sc Estimated Tax Payments 2024 Raf Leilah, Despite the irs referring to these payments as quarterly estimated taxes, the due dates don’t necessarily fall. Making estimated tax payments on time has benefits beyond maintaining compliance.

Federal Estimated Tax Payment 2024 Kacey Mariann, Try keeper's free quarterly tax calculator to easily calculate your estimated payment for. If a federal tax deadline falls on a weekend or legal holiday, the due.

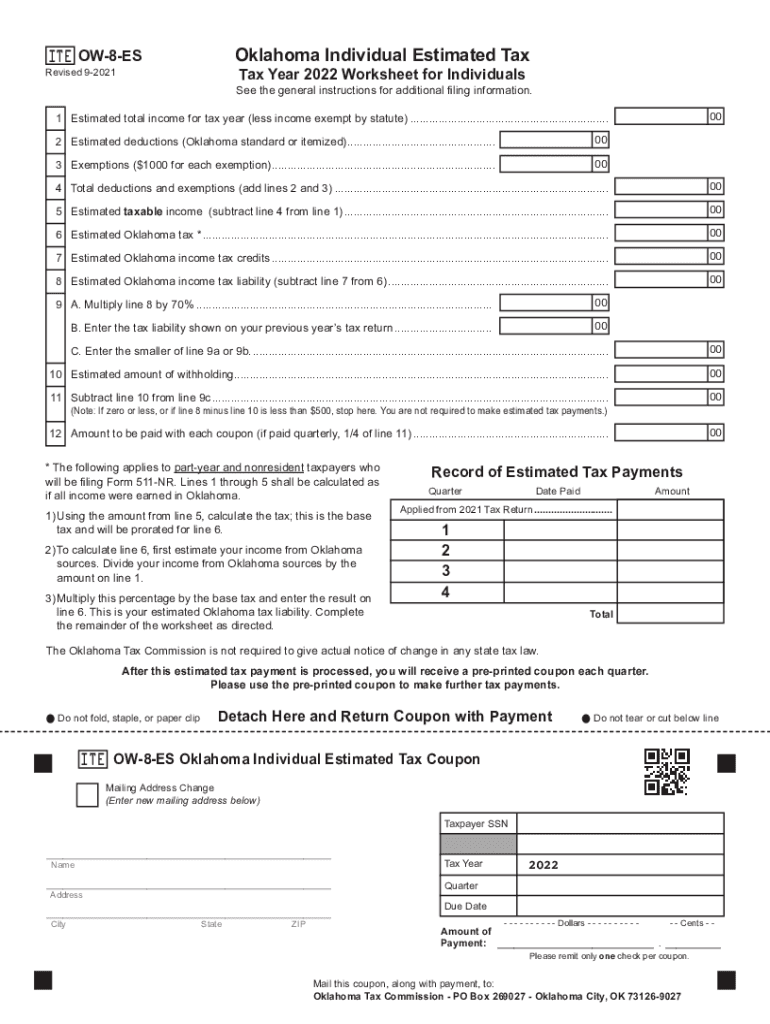

Etsy Taxes 2024 LLC, Deductions & Estimated Taxes Essential Guide, Llc estimated tax payments should be paid by your business throughout the year to help reduce the impact at tax time. Estimated tax is used to pay not only income tax, but.

Sc Estimated Tax Payments 2024 Raf Leilah, We'll make it easy for you to figure out if you have to pay estimated taxes and if so, how much. Penalties for not using or incorrectly reporting tins on estimated tax payments.

How Much Will I Pay In Taxes 2024 Lola Sibbie, At creative advising, we prioritize this. Filers may owe estimated taxes with.